Top Ratings Verdict

When the you are but really locate the new automobile, and need a choice of auto funds choice, creating your pursuit with an automobile broker that provides Friend automobile finance try well-advised. Provided, you will likely not discover much concerning APRs unless you make it, and will need to have the agent to discover the processes started. But if you do register for an ally car loan, the brand new account management solutions on the internet and through the cellular software are great, and you can youll have probably a loans deal that suits the priorities that can never be available elsewhere.

Friend might have been at the forefront of vehicle financial support because starting their doorways since upcoming entitled GMAC in 1919. Across 100 years from trading as, Friend no credit check installment loans in London has actually consistently considering the very best automotive loans (opens up in the the fresh case) to Western people and always reappraised the car funds alternatives since the brand new motor community advanced.

Ally is among the best five biggest auto lenders in the fresh new U.S., and possess thought to be one of the major digital monetary properties enterprises overall. A commitment so you can would correct by the the people matches this new push so you’re able to innovate perfectly. If you’re always preserving a focus on the automotive loans by which every thing first started, Friend has expanded usually to supply online banking, personal loans (reveals from inside the the new loss) and you may home loans, close to other automobile relevant functions such stretched vehicle guarantees (reveals from inside the this new tab) .

Ally Car finance feedback: Qualification

- Network from signed up traders

- No sign of credit requirements

There was absolutely nothing information regarding loan qualifications on Ally site in respect from called for credit ratings, however it is verified one to any auto you buy must be below ten years old and have less than 120,000 miles on clock.

Discover an ally car loan, you’ll also have to purchase your the fresh new automobile from a great participating dealer. However, with Friend already providing over 18,000 vehicles people – and most five mil of the retail users – this shouldnt depict too much of a boundary to finding a beneficial new automobile.

Ally Car finance opinion: Application procedure

Software processes: Head broker application ount, terminology and credit score Charge: Charge pertain, perhaps not unveiled Financing terminology: several – 84 weeks

- Started by car agent

- Pick A supplier app on the internet

Since it is the automobile specialist that starts the vehicle mortgage software procedure in the place of your dealing with Friend really, there’s absolutely nothing detail on the internet site with what you could potentially anticipate. it means that whoever has monitoring of an effective car and simply require the finance planning punctual will be greatest addressing some one such as for example LightStream (opens when you look at the this new tab) for their auto loan.

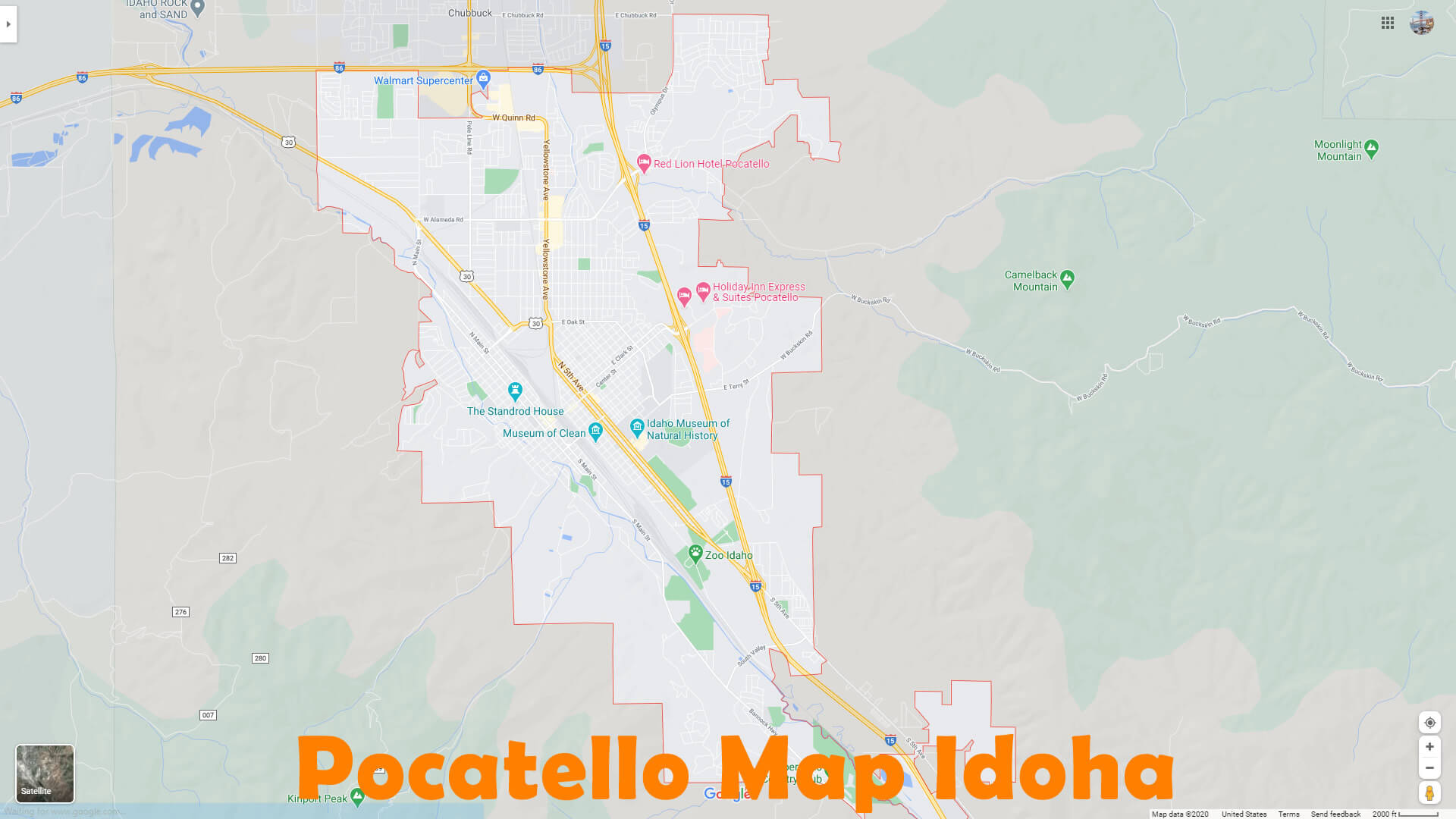

That being said, if the youre still looking your perfect automobile, and you can would rather a friend mortgage, you truly don’t brain brand new visit to the car agent in order to rating some thing become. Contained in this respect, this new Ally web site – that is well laid aside and simple to make use of – possess good Select A seller app towards which you put your target and you can vehicles brand you are longing for. A chart quickly seems making use of the closest possibilities, and you will useful guidelines to make you the new package entrance in the fastest you are able to go out.

Friend Car loan comment: Essential info

- Negotiate your Apr

- Book financing solutions

Towards the broker the answer to the automobile mortgage processes, certain details in relation to mortgage number and you may words are difficult to obtain. Everything we do know for sure would be the fact financing terms of ranging from 12 and you will 84 weeks appear, and this the later fee rules makes it possible for a grace period off ranging from eight and 15 days, ahead of a later part of the commission percentage for around 5% of the arranged payment per month count will be charged.

Beyond one, there can be an explanation on what your credit rating has an effect on your own Annual percentage rate, but unfortunately zero chosen indication as to what price you could need to pay. It is because your supplier commonly discuss your Annual percentage rate considering newest readily available cost, however, there are a warranty that price does not go beyond 19% or even the condition restrict, whichever is gloomier.

What’s explained inside the increased detail are definitely the significantly more book loans possibilities that are offered. The original of them ’s the Ally Balloon Advantage program one to enables you to build down monthly installments in favor of an enormous balloon fee after the newest bargain, though it are only able to be taken towards certain types of vehicle. Another program is actually Customers Alternatives which blends each other to invest in and you can leasing alternatives towards you to definitely package designed to fit customers spending plans.

Friend Car finance opinion: Solution

- On the internet and cellular administration

- Underwhelming customers evaluations

After youve started accepted for a financial loan and just have your car or truck, your negotiations that have Ally be more lead and you will most start seeing as to why Ally is considered the best car debt collectors.

Of the becoming a member of their on the internet system, you can examine their percentage reputation, equilibrium and you can comments each time in the online dashboard and/or cellular software. You can also update your private information, create repayments, and possibly plan to pay off the loan early. Regarding money, you will find an auto pay and you will an immediate pay alternative that immediately after activated will make sure you usually see your personal debt. The working platform is simple so you’re able to browse and you will comes with a number of of good use notion and you can pointers, and lots of of good use Faq’s.

Friend has actually an a+ get throughout the Bbb (reveals in the new case) , even after users awarding they an average of one star regarding five having provider. Its rating from almost one or two away five towards ConsumerAffairs (reveals into the the newest loss) are slightly a great deal more guaranteeing, but not excellent, though it will be recalled your prominent financial companies focus analysis according to all their attributes, and not only automobile financing.

Should you an ally Car finance?

In the event that youre searching for an established car loan label and happier to strategy a provider to begin with, Friend was advisable for your requirements. Although some upfront factual statements about qualifications and you will possible APRs would be allowed, Ally has actually fund options to fit all kinds of debtor.

And once there is the financing, Friend actions right up another gear, with a superb on line function additionally the capacity to would almost everything from cellular application too.