Thinking of buying a property that have student loan loans? Envision relocating to Maryland. The latest hook: You have to pick property when you look at the Maryland. And you’ve got to reside it for around five years.

The applying functions by paying down pupil loans as an element of purchasing the family. Maryland SmartBuy requires the purchase of flow-in-in a position homes already owned by, and you may offered by, the state of Maryland.

Predicated on revealing of the Training Month, brand new have repaid at the very least $7 billion for the student education loans thus far. There were at least 216 house ordered in system, which have $47 billion altogether mortgages issued.

System Eligibility

So you’re able to qualify for both , homebuyers should have a preexisting student debt which have a minimum harmony out-of $step 1,100000. Maryland SmartBuy money provides to fifteen% of the house cost into borrower to repay the an excellent student obligations. age pupil debt relief off 15% of the home cost with an optimum rewards out of $forty,100000.

A complete pupil loans for at least you to definitely borrower must be entirely paid down during our home get, and you may homeowners must satisfy every qualification criteria on . Capable in addition to simply financing through chose loan providers and can also be simply get attributes belonging to the state and you will approved to buy within the program. They may be able plus just use loan providers in system.

The application premiered during the 2016 and you will is so effective with its first 12 months that the County of Maryland somewhat expanded the amount off domiciles designed for .

Inside Maryland, almost 60 percent of all of the of one’s students was graduating with several thousand dollars from inside the student personal debt. That it economic load suppress of numerous more youthful Marylanders from reaching financial safety which is good roadblock to help you homeownership and you will protecting to have retirement, said Governor Larry Hogan inside the a statement. Today, all of our management was satisfied in order to commemorate a very profitable inaugural 12 months regarding Maryland SmartBuy 2.0, whereby Maryland homebuyers has actually removed huge amount of money when you look at the pupil financial obligation when you’re repaying down right here inside our higher county.

To support Maryland SmartBuy 2.0, Governor Hogan considering $step 3 million https://paydayloanalabama.com/eagle-point/ with the program within his Fiscal Year 2019 finances. Due to demand, the new ent considering a supplementary $3 mil inside the link funding through the Deposit and you may Payment Recommendations Program, getting rid of all in all, $6 billion in the pupil obligations, normally $twenty-eight,100 for each and every participant. For Fiscal Seasons 2020, Governor Hogan possess doubled the newest program’s brand spanking new capital to help you $6 mil.

How it functions

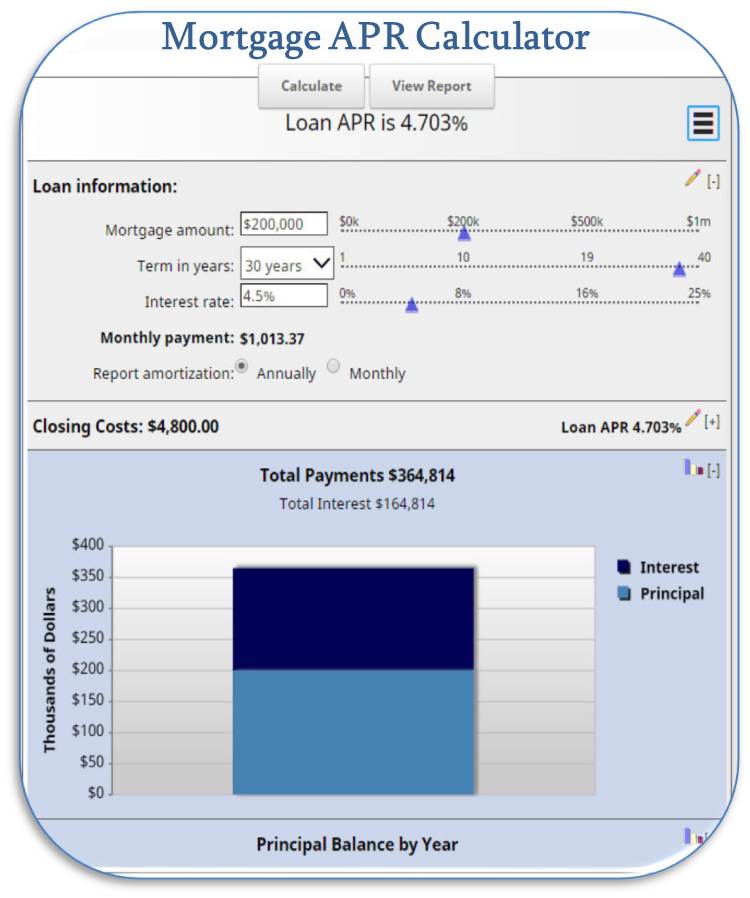

Consumers can be funds to 95% of your conversion cost of the home through a 30-season traditional amortizing real estate loan. It means a down payment requirement of 5%. Yet not, To $5,one hundred thousand during the deposit help is available. It comes down in the way of a zero percent loan, 3rd position lien on the possessions

According to the system, the customer might signal another home loan regarding count of up to fifteen% of one’s price of the home. It number must be sufficient to entirely pay-off the brand new borrower’s a good college student obligations equilibrium at the time of the acquisition.

Following, to settle student personal debt, the following home loan are good five-12 months forgivable home loan all the way to 15% of one’s price. This will wade myself toward make payment on borrower’s college loans during the total up to a limit out of $40,000.

So it 2nd home loan has no attention, no payments due. It would be secured by a moment lien on property. Every year, 20% of your own amazing next financial equilibrium might possibly be forgiven. Just after 5 years possess elapsed, the 2nd financial are forgiven. What you need to would are maintain the mortgage payments and stay home just like the proprietor-renter for 5 years.